Form 3468 Solar Panels

Enter the asset in screen 16 depreciation 4562 if depreciable.

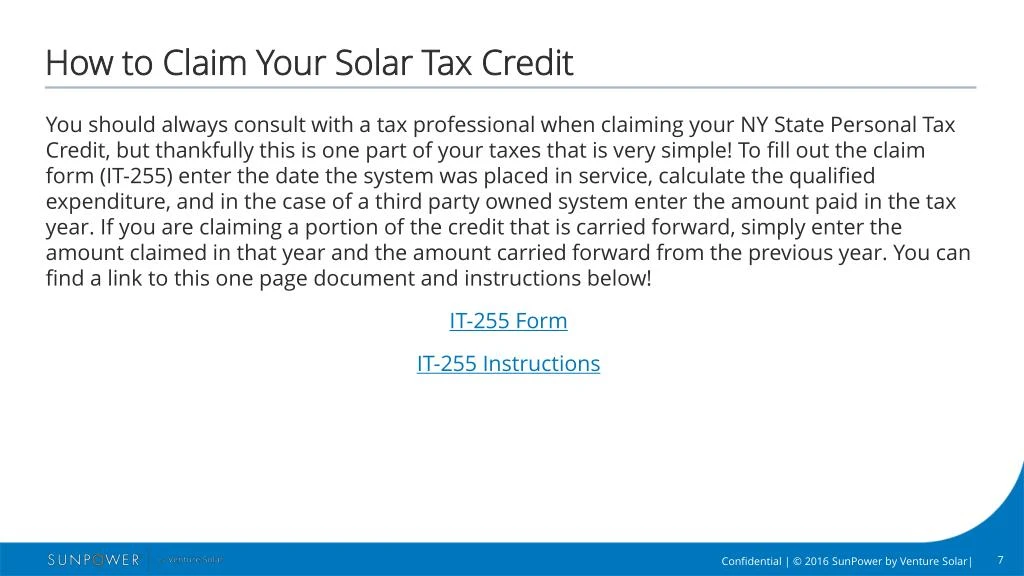

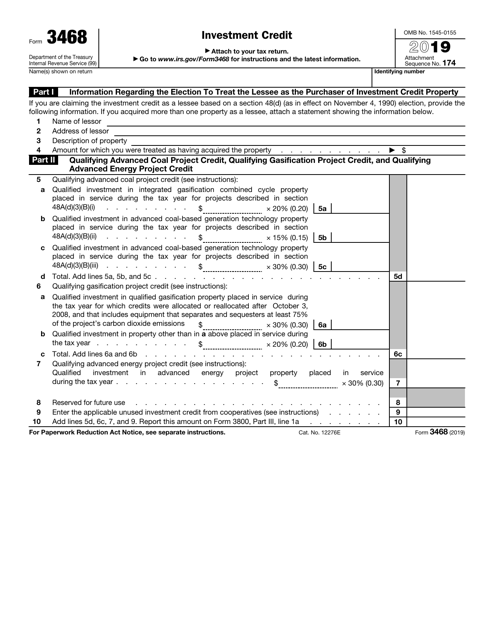

Form 3468 solar panels. The investment credit consists of the following credits. Basis of property using solar illumination or solar energy placed in service during the tax year and the construction of which began in 2020 see instructions. Combined heat and power system property see instructions. Purpose of form use form 3468 to claim the investment credit.

Enter the cost of the solar panels in field basis of property using solar illumination or solar energy 30 note form 3468 does not generate in the s corporation return. Using form 3468 for commercial installation of solar panels 40k. Go to screen 26 2 credits schedule k section investment credit 3468. Form 3468 is used to claim the investment tax credit.

Form 3468 department of the treasury. The investment credit consists of the rehabilitation energy qualifying advanced coal project qualifying gasification project and qualifying advanced energy project credits. Information about form 3468 investment credit including recent updates related forms and instructions on how to file. The election to treat a qualified facility as energy property is made by claiming the energy credit with respect to qualified investment credit facility property by completing form 3468 and attaching it to your timely filed income tax return including extensions for the tax year that the property is placed in service.

Use this form to claim the investment credit.

.jpg/:/cr=t:0%25,l:0%25,w:96.95%25,h:100%25/rs=w:365,h:365,cg:true)