Do Bill Credits For Solar Panels Ever Get Paid

If you use gas your solar panels won t cover the gas portion of your utility usage so you ll still need to pay for that as usual.

Do bill credits for solar panels ever get paid. What is a feed in tariff. The solar tax credit expires in 2022. Awarding credits at retail rates so most folks choose to take the credit. These savings depend on factors like the size of your solar panel system your energy consumption and your local utility rates.

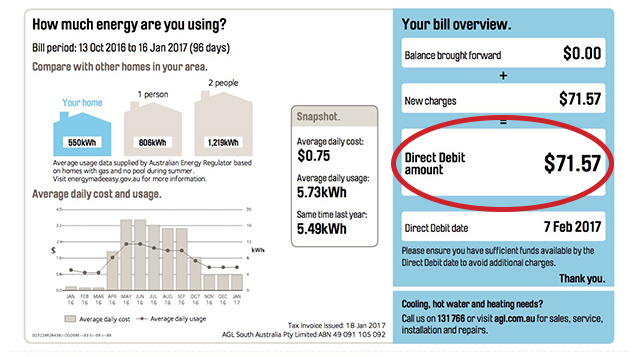

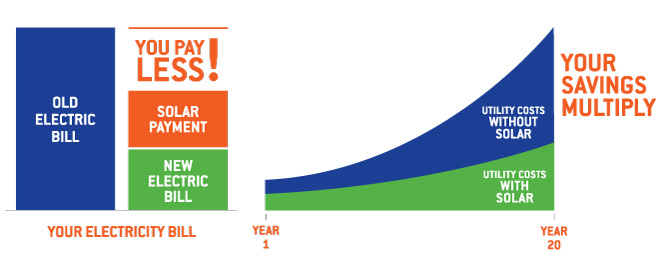

After going solar the first thing you will likely notice is the drastic decrease in your monthly electric bill. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation. Some will continue even after the federal credit expires. With a net metering agreement you get credit for that excess electricity usually as a kwh credit that will show up on your next month s bill or as a total sum at the end of the year.

Getting your state s tax credit many states also offer tax credits for solar. That means that if your system costs 10 000 you get a 2 600 credit on your federal taxes. Most net metering agreements use one meter to track net energy consumption energy used minus energy generated from solar and bill everything at a uniform rate. The tax credit is applied to your federal income taxes and can greatly reduce or even eliminate what you owe.

The federal government provides a 30 percent tax cut on solar installation costs though that program is set to end this year with nothing in the works to replace it. When you re considering going solar don t forget about the federal tax credit for solar it s one of the best incentives in the country. That amount is then divided into consistent monthly payments for the term of your lease. If you like consistency this is the one for you.

However most utilities pay reimbursements at a wholesale rate vs. You ll pay the bill annually although you may receive a quarterly or monthly statement that breaks down your usage and credits. When you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return. Under most net metering agreements the utility will reimburse you for excess generation either through a check or energy credits toward your future bill.

You can reduce the amount you pay in taxes by 26 percent of the cost of your solar panel system. When your solar panels produce more solar power than you use your solar energy system sends the excess solar energy to the grid. That s in addition to local incentives buyers could use. With a solar lease the bill from your solar provider is the same every month.

This fixed figure is established by the amount of power your panels are designed to yield over their 25 year lifespan. If you spend 10 000 on your system you owe 2 600 less in taxes the following year.